Bitcoin has clawed its way up from its $81,000 lows and is now holding above $90,000.

How high can the OG crypto fly?

The 4-hour chart is already hinting at the spots where the bears might try to jump in.

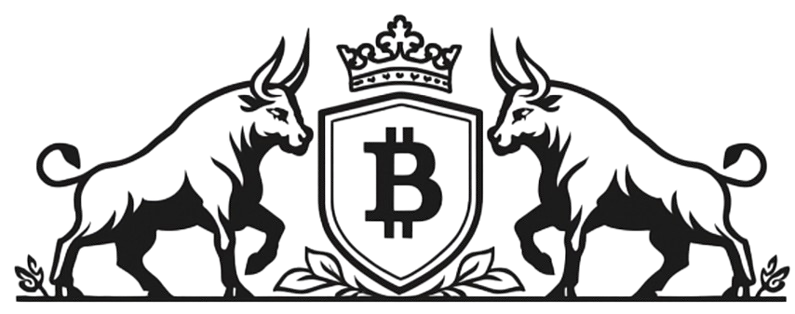

Bitcoin (BTC/USD) 4-hour Chart by TradingView

Bitcoin (BTC/USD) broke from the rest of the risk crowd on Tuesday, pushing higher even as equities cooled off, and it did so without any obvious spark. Profit-taking from previous downswings and talks about a possible “innovation exemption” from the U.S. SEC Chairman likely helped keep the crypto mood lifted.

At the same time, the U.S. dollar kept slipping against the majors as traders leaned harder into Fed rate cut expectations. Momentum picked up once markets started entertaining the idea that Kevin Hassett, a White House adviser who favors lower rates, could replace JPow early next year.

Remember that directional biases and volatility conditions in market price are typically driven by fundamentals. If you haven’t yet done your homework on the U.S. dollar and the bitcoin, then it’s time to check out the economic calendar and stay updated on daily fundamental news!

BTC/USD, which has been trending lower since October, is making its way toward a key resistance zone after bouncing from its $81,000 November lows.

We are looking at the $96,000 handle, which lines up with the 50% to 61.8% Fibonacci retracement area and the 4-hour 200 SMA.

More importantly, $96,000 sits close to the trend line resistance that has been in play since October.

Red candlesticks and early signs of a bearish turn could pull BTC/USD back toward the $84,000 handle or even the $81,000 previous lows. But if the upswing keeps going and BTC/USD holds above $96,000, the crypto could be on its way to revisiting the key $100,000 psychological level.

Whichever bias you end up trading, don’t forget to practice proper risk management and stay aware of top-tier catalysts that could influence overall market sentiment!

Disclaimer:

Please be aware that the technical analysis content provided herein is for informational and educational purposes only. It should not be construed as trading advice or a suggestion of any specific directional bias. Technical analysis is just one aspect of a comprehensive trading strategy. The technical setups discussed are intended to highlight potential areas of interest that other traders may be observing. Ultimately, all trading decisions, risk management strategies, and their resulting outcomes are the sole responsibility of each individual trader. Please trade responsibly.